Gold Weekly Report (XAUUSD): 2026-02-15–2026-02-22 | Macro Drivers

1) Weekly snapshot

Report window: 2026-02-15–2026-02-22. Last print provided: 5098.7 at Fri, 20 Feb 2026 21:55 UTC (UTC time preserved from the dataset).

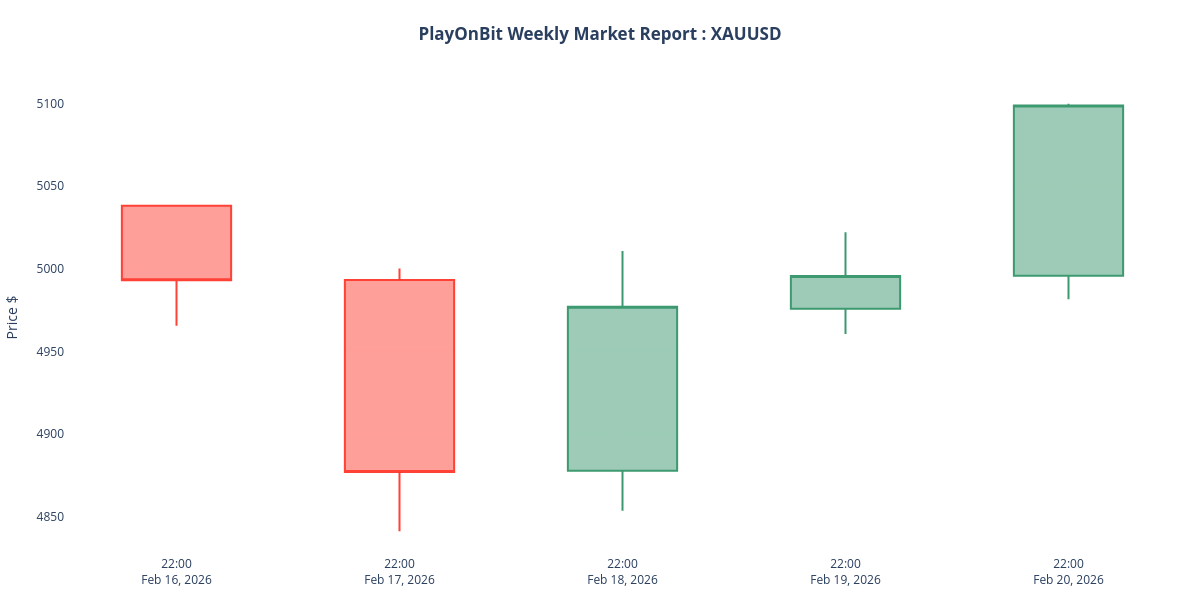

2) Price action & OHLCV

The dataset's ISO week summary (Mon–Fri) reports week_start 2026-02-16 to week_end 2026-02-20 with open 5038.12, high 5099.73, low 4841.33 and close 5098.7, total volume 3,940,951. Note: the 1w_summary uses the ISO Mon–Fri window (returns current ISO week Mon–Fri UTC). The sequence shows a mid‑week washout to 4841.33 followed by a strong recovery and a close near the weekly high, implying rejection of lower levels and a short‑term bullish recovery in structure. For level context see gold technicals.

3) Macro drivers: USD & yields

The US Dollar exhibited modest strength over the week with the DXY around 97.79 on the latest close in the provided series. US Treasury yields were steady to slightly higher by week end: the 5‑year near 3.65% and the 10‑year near 4.086%; these levels are consistent with a cautious market pricing of Fed policy and are supportive of a firmer USD backdrop. Taken together, a firmer DXY and elevated yields are a headwind for dollar‑priced gold, while any back‑and‑forth moves in yields or the DXY could quickly flip intraday flows into gold. See analysis of the dollar and yields relationship for more detail.

4) Calendar & catalysts

This week featured multiple Fed speakers and high‑volatility US releases. The FOMC Minutes were released on Wed, 18 Feb 2026 19:00 UTC and were a focus for markets. A heavy US data slate including GDP and core PCE prints landed on Fri, 20 Feb 2026 13:30 UTC and influenced intraday moves. ECB President Lagarde also spoke (dataset entries on Sun, 15 Feb 2026 09:30 UTC and Fri, 20 Feb 2026 12:00 UTC), and each central‑bank voice added to headline risk and cross‑asset volatility. Traders should note that high‑volatility events listed in the dataset can compress liquidity and widen spreads around prints.

5) News themes (compressed)

Compressed news in the dataset highlights two durable themes. First, geopolitics (notably US–Iran tensions) repeatedly supported safe‑haven demand for precious metals during the week. Second, domestic US developments — including a US Supreme Court decision that moved the DXY and stronger‑than‑expected labour prints — created offsetting USD strength that capped upside in gold. The provided news sample counts 15 items with sentiment evenly split (bullish 5, bearish 5, neutral 5), underscoring a balanced mix of upside tailwinds and downside catalysts.

6) What to watch next week

Monitor DXY direction and the path of US yields for the primary macro bias that will influence XAUUSD flows. Track upcoming Fed speakers and any follow‑up Fed communications to the FOMC Minutes, as hawkish or dovish tones will be received quickly by rates and the dollar. Watch geopolitical headlines for sudden safe‑haven moves; escalation or de‑escalation can rapidly shift gold positioning. Pay attention to liquidity windows around major data and central bank events, and use event‑aware sizing rather than larger overnight exposures.

7) Conclusion

Gold closed the ISO week with a decisive recovery from mid‑week lows but remains sensitive to USD and yield dynamics and to geopolitical headlines. Keep event risk central to trade plans and use adaptive risk management. For execution and automated assistance consider the Trade Assistant Bot and explore resources at PlayOnBit.