BitMEX Trading Bot

Trade Bitcoin with ease using PlayOnBit's advanced automated strategies. Our unique selling point lies in our smart AI-enhanced trading bot, which not only creates customized strategies but also executes Bitcoin trades automatically. With PlayOnBit, you can experience secure and hassle-free trading, all at your fingertips. Try our innovative platform today and unlock the potential of automated Bitcoin trading.

Get to Know our AI Enhanced BitMEX Trading Bot

Our BitMEX trading bot is a trading platform that provides an interface for BitMEX cryptocurrency exchange. Whether an experienced trader or not, we Automatically maximize your profit along minimising your loss. By using our interface and your API key from BitMEX you can take advantage of the unique features provided by us to automatically trade Bitcoin through our AI Enhanced trading bot. You can easily track and check your Bot's performance at any time. No need for adding complex algorithms like other platforms. You can customize your bot in whatever way you feel best.

What Is BitMEX?

is an abbreviation for "Bitcoin Mercantile Exchange." It is a cryptocurrency trading platform,

specifically one of the largest. The flagship product of the platform is cryptocurrency derivatives.

Its daily transaction volume exceeds 35,000 bitcoins, it supports more than 540,000 monthly

accesses, and it has a transaction history of more than $34 billion of Bitcoin since its inception.

At BitMEX, investors can interact with the financial markets using bitcoin. Bitcoin, Bitcoin Cash,

Cardano, Ethereum, Litecoin, Tron, and Ripple are some of the supported cryptocurrencies.

In our opinion, BitMEX is one of the most powerful exchanges out there when it comes to derivatives

trading. However, we have to emphasize again that this type of trading is not recommended for the

vast majority of users. Being in Seychelles may not be the exchange facing strong regulatory laws.

If you want to start trade, it should be your first choice.

BitMEX is a special cryptocurrency exchange

BitMEX is one of the most serviced cryptocurrency exchanges in the world. It offers many types of

orders. We will try to explain the most important ones.

Its services and features significantly differentiate it from most of the most common and used

cryptocurrency exchanges such as Binance or Coinbase. Mainly because BitMEX allows you to trade

downwards, also known in terms of short positions with special features, which is great because

it will enable investors to earn even in the worst moments of the cryptocurrency market.

Investors can analyze one of the cryptocurrencies listed on the platform, such as Bitcoin or

Ethereum, and decide where the price and risk will move. For example, if we believe that the price

of the cryptocurrency we have analyzed will fall, we place a sell order looking for lower levels,

and the opposite if we think that the value is going to increase.

Another feature where BitMEX differs from most exchanges is that it hardly accepts Bitcoin deposits.

BitMEX is specialized in advanced financial operations such as margin trading and trade with

leverage. BitMEX is currently not regulated in any jurisdiction, which sets it apart from other

cryptocurrency exchanges.

BitMEX also differs because it allows leverage; whatever your balance is available for trading,

you can increase your purchasing power by using leverage. Later we will explain how. The platform

itself lends us the balance to carry out the trading if we need it.

How to Register on BitMEX

You should visit

BitMEX.com

Then, tap the Register option. Then, enter your valid email address

correctly and select an appropriate password to complete the registration to create an account.

An Email will then be sent to your email confirming your email address by tapping the link sent.

Finally, ensure that two-factor authentication is enabled to make your account more secure.

How to deposit money to your BitMEX account?

At the top of the page, select the Account number menu, in which case you will have access to your software wallet. By tapping the green Deposit button and then scanning the QR code or copying your wallet address, you will be able to deposit bitcoins into your account.

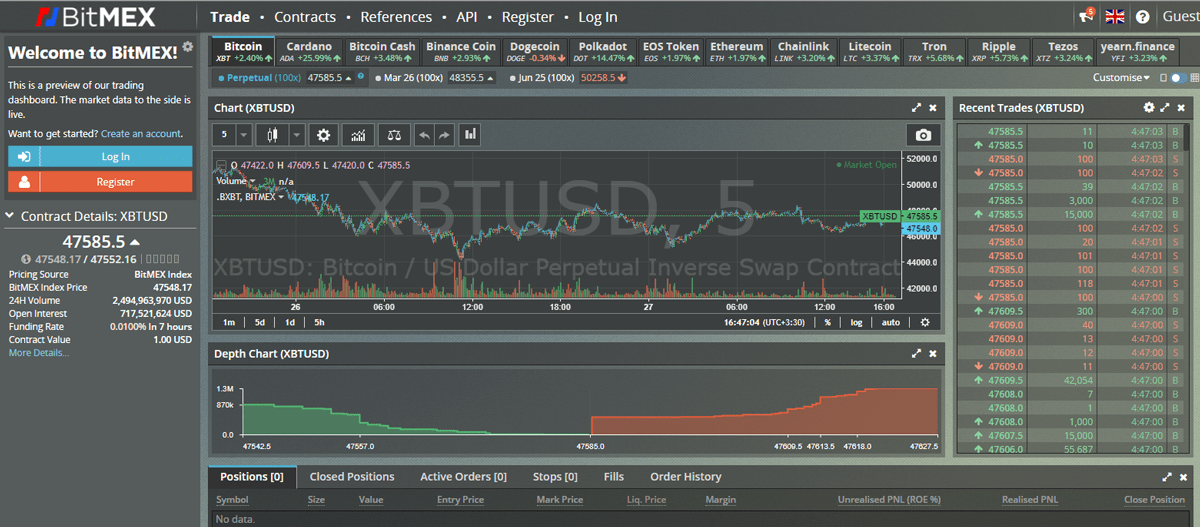

How to trade in BitMEX?

At the top of the BitMEX Exchange website window, click on the Trade option. In this case, you will go to the trading window where you will be able to buy or sell cryptocurrency from the list of available coins. You can select the desired cryptocurrency for the transaction.

What is it like to enter a trading position in BitMEX?

On the left side of the transaction window, enter the type of order of your choice in the Order field. For example, enter the Market command in the relevant box, and enter the amount of your trade or the desired amount you use for the buy or sell transaction. The selected amount must be in US dollars or USD.

How to deposit on BitMEX?

In the BitMEX interface, you can find a box to set orders. You also have a market option to trade

at current market prices. Other features to look out for include Limit and Stop, which allow you

to buy or sell at levels you have decided on, assuming the market reaches those levels.

Remember that "market" operations are buying and selling at real prices. There are three main

things to keep in mind from the start. First is the dollar amount you want to invest.

Do not forget that the cost of the operation also appears in XBT.

The minimum amount deposited into a trading account is 0.001 BTC.

Therefore, you must exploit the "Order Value" function that shows you the amount of cryptocurrency

that the dollar amount you entered will buy. The level of leverage you use will affect this.

Below the order section is the leverage indicator. The default value is zero, which means that

if you buy the equivalent of $1,000 USD in cryptocurrency, the price will double. Therefore,

your participation will have a value of $2000 USD. If the value drops to zero, your stake

will be worth zero.

How to withdraw money from BitMEX?

There is no limit to withdrawing Bitcoin, and it should be noted that no other competitor offers

this, so BitMEX is a leader in this regard.

The withdrawal method on BitMEX is another attraction of the platform since receiving money is

relatively simple due to its fast and easy interface. While deposits can also be made quickly

and 24 hours a day, all withdrawals are done manually and using a specific method.

It means that there is a level of security in the process. It also makes it

possible to detect suspicious movements or attempts to commit fraud by the platform.

However, any fiat currency is not currently available for any form of payment. Calculate your

withdrawals in cryptocurrency instead of the cash you plan to transfer.

How to use BitMEX?

This platform does not have a smartphone application, regardless of whether it is Android or iPhone.

The only recommended option is to always access from a desktop version.

BitMEX uses auto-leverage to ensure that liquidated positions can be closed, preventing the volatile

state of the market from influencing. On the website of the exchange, they explain this section better.

How to create a position?

There are two main options when trading on a buy or sell position. These options have a series of

parameters that are common to all the orders that we can give:

Quantity: The money to buy and the value vary depending on the "Leverage"

parameter explained later.

Buy/Long: Execute a buy or long order.

Sell/Short: Execute a sell or short order.

Cost: The price we put on the position.

Ordervalue: The value with which the position is opened and based on it.

"Cost" x "Leverage".

Available balance: The available balance we have.

Total balance: balance in orders that we have placed.

Leverage: It allows X1, X2, X3, X5, X10, X25, X50, and X100, although it is

possible to edit to other values.

An essential requirement to operate on the platform is a minimum amount required.

It varies depending on the order and the initial margin. So before trying to operate we must ensure

that we have sufficient funds for it.

Order in BitMEX

BitMEX offers a variety of order types for users:

Limit order: The order is fulfilled if the given price is reached. The user has to

specify a maximum or minimum price at which he is willing to buy or sell.

Market order: The order is executed at the current market price. Generally,

this type of order is used when you have a rush in buy/sell.

Stop order: This order only appears in the order book when the market reaches a

certain trigger price, and it is usually used to carry out two strategies.

Stop loss: To limit losses on positions.

Take Profit: This order is executed when the price moves in a favorable direction

and will be executed when the preset trigger price is reached.

In addition to offering margin trading in all the cryptocurrencies displayed on the website,

the platform provides trading with futures and derivatives.

Leverage

Leverage occurs when an investor increases the total capital through a loan. The leverage allowed

by the platform will depend on the level of Initial Margin and Maintenance Margin. These levels

specify the minimum capital you must maintain in your account to enter and maintain positions.

The maximum leverage allowed by the platform is 100% on your daily Bitcoin futures contract.

You have to be very careful because, in the same way that it allows us to win more, it also allows

us to lose more.

There is the minimum amount of Bitcoin that you must maintain to open a position. If your margin

balance on BitMEX falls below this level, your position will be taken over by the liquidation

engine and liquidated.

Iceberg Orders

An Iceberg Order is a Hidden Order where a portion of the order is displayed in the public

order book. Because smart traders can identify hidden orders, some traders prefer to use this type

of order in an attempt to be indistinguishable from traders who keep refilling your order.

Is BitMEX a secure platform?

Two-step authentication (F2A) does a lot to protect our funds and assets (don't forget to

activate it!), but other security features attack very specific risk vectors.

So that we are sure when we have received a fake email pretending to be BitMEX, we can configure

that GPG is used to encrypt all our emails with the platform.

When you log in, you will receive an email with the IP address where the login was made,

which makes it very difficult for someone to log in to another account without the latter noticing

Many BitMEX user email addresses were leaked in November 2019, but no single BTC has

ever been lost to theft on the platform despite this privacy issue.

Is BitMEX regulated?

BitMEX is a company registered under the company HDR Global Trading Limited, which is registered

and licensed in the Republic of Seychelles under the number 148707.

The company has been registered since 2014, so it is a veteran player in the market, and this means

that it is an Exchange with a view to the long term.

However, the exchange does not accept clients from the United States or the United Kingdom.

In the first case, he is under investigation by the FCTC for offering futures and derivatives

to American citizens without authorization. In the UK, for example, cryptocurrency trading has

been banned, so you cannot use services there.

Account security is taken seriously, and there are no known cases of cryptocurrency hacks, which is

unusual in the industry, where even big names like Binance have had cases in the past. It is a

point in favor in terms of the exchange's reliability.

The security processes to identify clients follow all the steps of the industry with the need to

enable 2FA authentication to be able to carry out transactions. In addition, identity must also be

verified by sending identification documents, which are also verified with selfies and some tasks

that must be done.

It is generally a safe Exchange, and at the moment, it seems to be trustworthy.

Advantages of BitMEX

It is one of the most popular cryptocurrency exchanges for margin trading.

It has very low commissions, something important for experienced traders is a specialized exchange.

It offers few products but the ones it provides do so under excellent conditions.

No withdrawal or deposit fees.

It boasts of not having been hacked during these years, making it one of the few exceptions that

we know of in this sector.

Registration is simple and fast.

Provide a free demo account. Again, one of the few in the industry to do so.

Disadvantages of BitMEX

It does not have other services such as staking or loans, something that many blockchain lovers like.

It does not accept clients from certain countries such as the US or UK.

It is not a platform suitable for mobile/cellular trading.

The platform, although advanced, requires some training.

Does not have customer service in some languages.

Commissions and fees

BitMEX does not charge any commission when sending them Bitcoin to buy orders or withdrawing

the Bitcoin when successful transactions pay us. We will only have to pay the basic commission

that any transaction on the BTC network has, and this money does not go to BitMEX.

Trading commissions depend on the type of contract and the underlying asset (cryptocurrency),

but for example, for a traditional futures contract, the maker will pay -0.025% and the taker 0.075%.

They may seem too low or even negative, but you need to understand how these fees work:

The commission is a percentage of the leverage of the order, that is, the amount of the order

multiplied by the leverage (up to 100x)

You have to buy the commission twice (entry and exit)

Negative commissions are a kind of discount that BitMEX offers because they are interested in there

always being supply in the market.

As for limits, for each trade, BitMEX asks that we have

Bitcoin deposited for the value of a part of the amount that we leverage.

What is BitMEX Testnet?

Because trading in futures mode is risky, BitMEX has created a testnet for newbie traders so that

users can start trading without financial loss to learn. Testnet is a kind of experimental test

network in which you can hypothetically trade with unreal money. Testnet is great for people who

want to test their trading strategy. Testnet features and tools are no different from real-time

BitMEX, and the only difference is that you are trading fake coins. Using testnet is also

free for users.

Although BitMEX makes a test platform available so that we can learn from it before jumping into

the pool. However, there have been some negative comments advising against such a platform.

According to what they say, prices move very differently from the real ones, and learning about

them is not something easy. It is not that bad. Perhaps it is better to start in the normal

one by betting insignificant amounts like $1. You will learn, and maybe you will start earning a little.

BitMEX Supported Countries

BitMEX does not provide services to some users around the world. This issue goes back to the

financial policies and legislation of this exchange. BitMEX records the people's IP who connect

to the exchange, and if you connect to the exchange from these countries, your account will be

locked, and it is only possible to withdraw the crypto from the exchange if you do authentication.

So if you have daily trading, do not connect to this exchange in any of the following countries.

BitMEX does not allow US-based users to use the facilities of this exchange.

Also, if you live in Cuba, Syria, Iran, North Korea, Crimea, Sevastopol, Luhansk, and Donetsk,

or are a citizen of these regions, this exchange will not allow you to use the facilities.

If you show your passport to this exchange and are in one of the mentioned areas, your account

will be closed entirely.

In addition, if you are in Seychelles, Bermuda, Hong Kong, Japan, Ontario, and Quebec in Canada,

you will not also receive services from BitMEX.

If you live in one of the other countries of the world, using BitMEX will not be a problem for you,

and you can easily become a member of this exchange or do KYC.

BitMEX API

BitMEX API allows you to connect a bot to

an exchange for trading. This connection is made via API, a type of port that a bot can connect to.

When you connect the bot to an exchange, you can easily send your orders to the exchange without

risking your property. In fact, money is still in your wallet, and you can only execute certain

commands via bots.

Using a bot allows you to trade much faster and more accurately. It is very suitable for people

who are open in many positions. This bot quickly closes and opens positions according to your

instructions. Using this bot will increase your profits and prevent you from being liquidated.

BitMEX Insurance Fund

BitMEX has a special program for users worried about losing capital. This exchange will

automatically prevent you from being liquidated if you lose your money through accidental events

such as making a stop loss.

The Insurance Fund is a savings account to prevent losses to the customer in a sharp and sudden

change in market price, which usually leads to the liquidation of open positions in exchange offices.

Traders who use 50 to 100 times leverage also pay higher fees directly into the insurance fund.

It is because of the increased likelihood that their position will be liquidated. In the event of

a BitMEX liquidation engine failure, for example, in the event of a sudden and unexpected fall in

the price of Bitcoin, this insurance fund will be used to compensate traders whose positions are

unfairly closed and causing losses.

This feature, called Auto Deleverage, is one of the best features of this exchange

that prevents the destruction of capital through accidental events.

There are very few exchanges that have such a capability.

BitMEX Trading Pairs

XBTUSD | ETHUSD | GMTUSD | NEARUSD | XBTUSDT | ADAUSD | SOLUSD | XRPUSD | AVAXUSDT | LTCUSD | XBTEUR | BCHUSD | DOGEUSDT | LINKUSD | AVAXUSD | DOTUSD | AXSUSD | SOLUSDT | APEUSDT | LTCUSDT | DOTUSDT | FTMUSDT | BNBUSDT | SANDUSDT | SHIBUSDT | ADAUSDT | MANAUSDT | XRPUSDT | METAMEXTUSDT | BCHUSDT | GMTUSDT | NEARUSDT | MATICUSDT | LINKUSDT | EOSUSDT | DEFIMEXTUSDT | ALTMEXTUSDT