Gold Weekly Report (XAUUSD): 2026-02-03–2026-02-10

1) Weekly snapshot

Report window: 2026-02-03–2026-02-10 for XAUUSD. Last price: 5,041.66 at Tue, 10 Feb 2026 02:10 UTC.

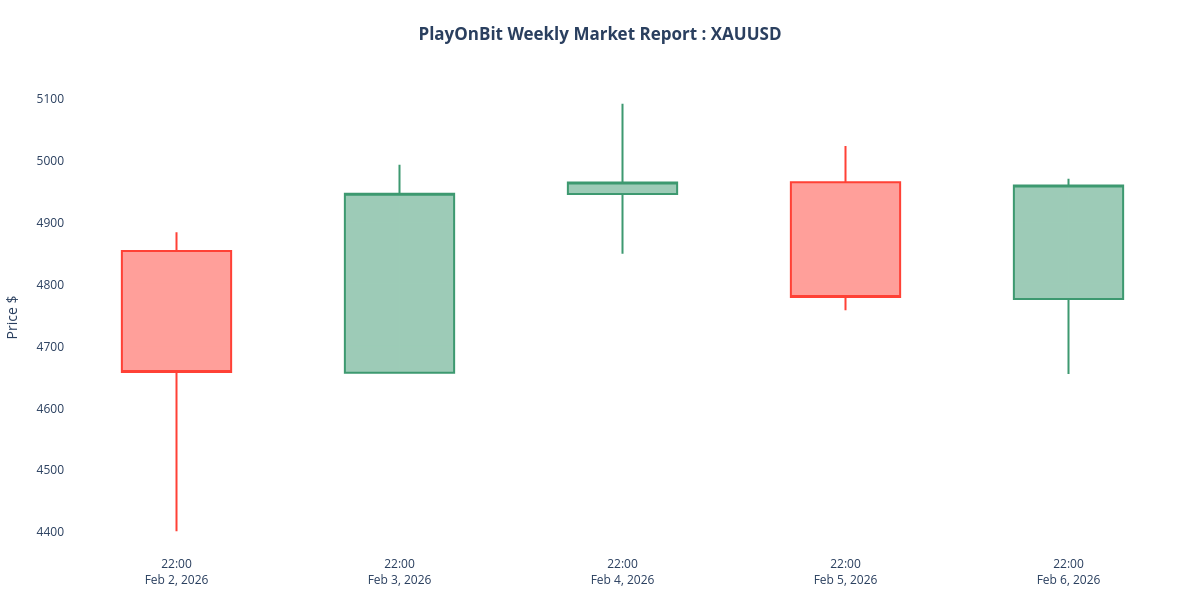

2) Price action & OHLCV

The official 1-week OHLCV summary in the dataset was computed for 2026-02-02 to 2026-02-06 (Computed from last completed Monday–Friday). That summary shows open 4,853.80, high 5,091.71, low 4,401.58 and close 4,959.84 with total volume 11,337,611. Notes provided with the summary state the values were computed from the last completed Monday–Friday (UTC). Price structure: the weekly close at 4,959.84 and the last quote at 5,041.66 sit above the weekly close but below the weekly high, indicating near-term upside pressure inside a volatile multi-hundred-dollar range rather than a clean breakout. This follows earlier record rallies (see Gold hits record high) and geopolitically driven surges.

3) Macro drivers: USD & yields

The US Dollar Index eased late in the week, with the latest DXY read at 96.898 (source: Yahoo). US 5-year Treasury yields moved lower to about 3.741% at the last reported read. US 10-year yields also eased to roughly 4.198% on the most recent data point. These softer USD and yield prints are consistent with part of the upside seen in XAUUSD, though risks remain if data or Fed messaging shifts expectations; see Fed-cut odds rise for background on how rate expectations affect bullion.

4) Calendar & catalysts

The dataset lists the Japanese General Elections on 2026-02-08 as a high-volatility event. The event fields for actual, consensus and previous are unavailable in the dataset. Market attention should remain on scheduled macro releases and any changes to the US data calendar reported in the news feeds.

5) News themes (compressed)

Compressed feeds show several recurring themes: continued PBoC central-bank buying (extended streak reported), mixed safe-haven flows tied to geopolitics (see Gold surges above $4,440), and episodic risk-off in crypto and silver that weighed on market tone. Headlines noted RBA hiking and regional policy moves, commentary around Fed leadership discussion, delayed US Nonfarm Payrolls and shifted US data dates, and technical commentary highlighting nearby resistance around 5,100 and support near 5,000 and lower moving averages. News statistics in the dataset show 17 highlighted items with 6 bullish, 6 bearish and 5 neutral pieces, reflecting a balanced but event-sensitive information set.

6) What to watch next week

Key items to monitor include incoming US macro prints that can reprice rate expectations and Treasury yields, any continued central-bank gold purchases, and follow-through on geopolitical headlines that affect safe-haven demand. Watch DXY and 5y/10y yield moves for directional confirmation and be alert for volatility around reported event dates called out in the feeds. Position sizing and clear risk levels are recommended given the wide intra-week range registered in the summary.

7) Conclusion

Gold remains sensitive to USD and yield moves alongside central-bank demand and headline risk; maintain macro-aware trade plans and check resources like Trade Assistant Bot and Forex Trading Bot for execution and signals. For broader market tools and updates visit PlayOnBit.